Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

YZiLabs’ call for a BNC board expansion marks a serious escalation in its concerns over CEA Industries’ governance and strategic execution. The group has filed a preliminary consent statement with the SEC, aiming to widen the board and introduce new directors with stronger oversight and operational discipline.

On November 27, 2025, YZiLabs submitted its consent statement to begin soliciting shareholder approvals for a BNC board expansion (yzilabs.com).

According to YZiLabs, the board expansion push is driven by mounting concerns, including:

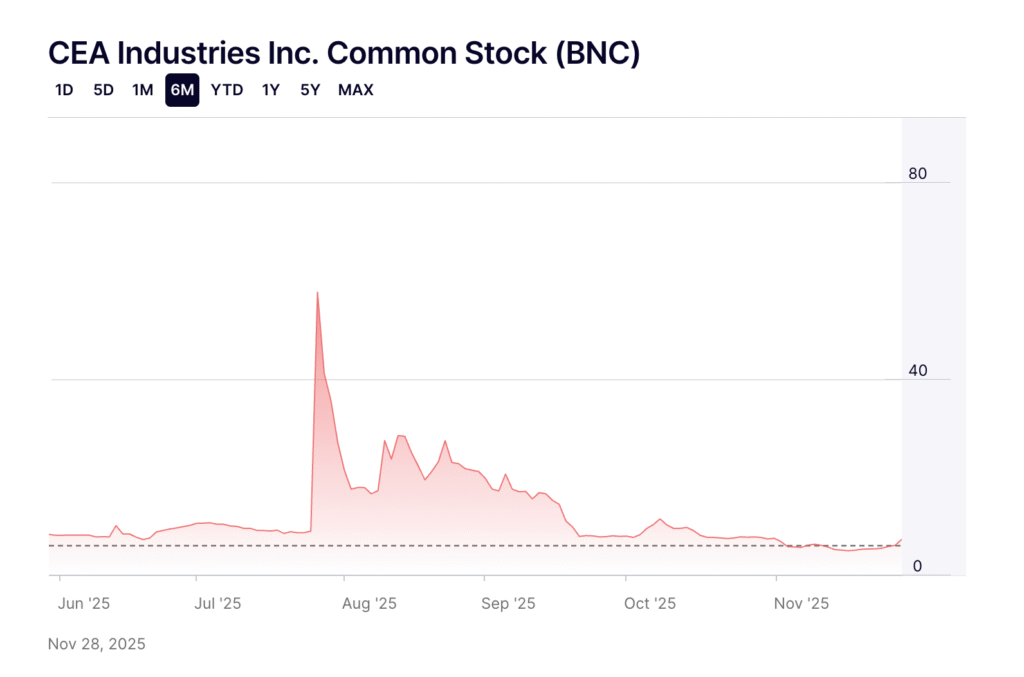

Despite completing a $500 million PIPE financing round and holding BNB as its core digital asset, BNC’s stock performance has lagged behind its treasury value.

YZiLabs believes this disconnect highlights internal governance and operational issues, not market conditions.

Ella Zhang, leading the governance initiative, stated that shareholders “can no longer afford to wait” for improvements.

The proposed YZiLabs BNC board expansion focuses on:

YZiLabs stresses that the board expansion is not meant to alter BNC’s digital asset treasury strategy.

Instead, it aims to ensure the strategy is executed more clearly, consistently, and responsibly.

YZiLabs currently holds:

The consent effort also includes the involvement of YZiLabs Management, Changpeng Zhao (CZ), and a soon-to-be-announced slate of board nominees.

The goal is to add capable leadership without disrupting the company’s existing treasury philosophy.

The YZiLabs BNC board expansion reflects a growing wave of shareholder activism across crypto-adjacent public companies.

Investors are increasingly demanding:

Consent solicitations are becoming a preferred mechanism for shareholders seeking accountability and improved board performance.

If successful, the YZiLabs BNC board expansion could mark a turning point for CEA Industries.

Stronger oversight, improved transparency, and a more effective board may help unlock the company’s true value and bring BNC’s market performance closer in line with the strength of its digital asset holdings.