Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

DeFi has opened the door to a new era of on-chain opportunities, but anyone who has tried to farm yield for more than a week knows the truth: it’s complicated. Protocols change, APYs jump around, and the manual work of chasing rewards becomes exhausting fast. Many users end up spending more time managing positions than actually earning.

Concrete is trying to fix that problem by taking the heavy lifting out of yield generation.

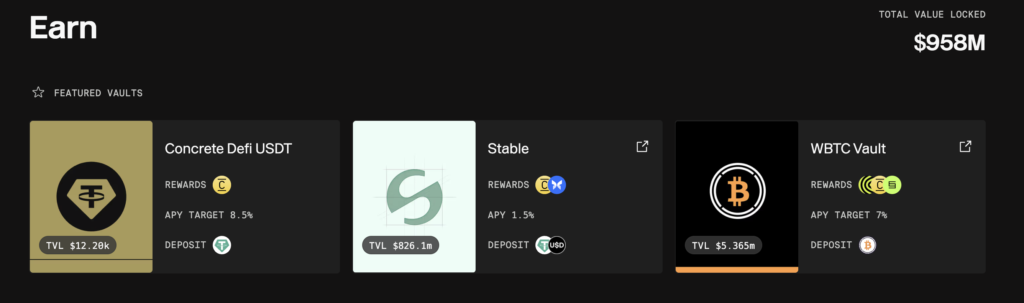

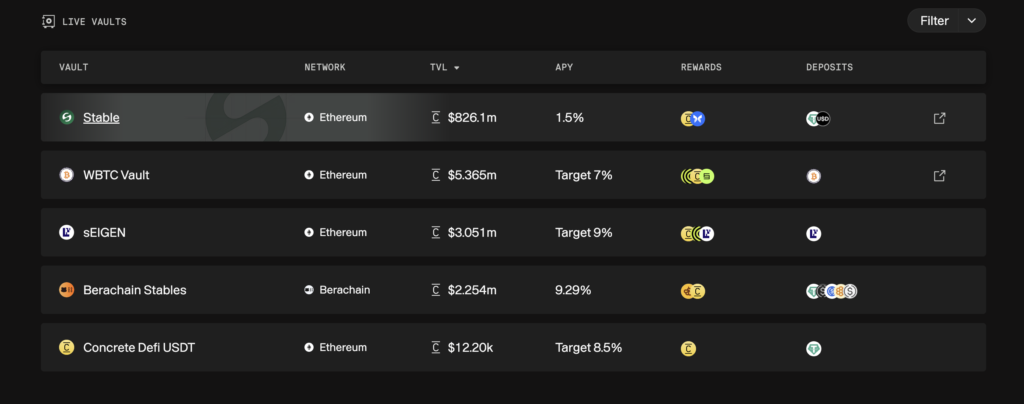

A Concrete Vault is an automated smart contract that allocates your crypto across multiple strategies to earn risk-adjusted yield for you. Instead of tracking farms, monitoring risks, or compounding rewards, the vault handles these tasks in the background. You deposit once, and the strategy keeps working.

Most people don’t have the time—or desire—to become experts at yield farming. And even for those who enjoy digging into protocols, the space moves quickly:

A DeFi vault simplifies all of this. Concrete builds vaults so regular users and professionals can earn predictable, optimized returns without monitoring charts and dashboards all day. It’s DeFi made simple, in the literal sense.

Every Concrete Vault uses quantitative models to evaluate risk and reward. Instead of chasing the highest number on a dashboard, the vault reallocates capital to options that offer the best risk-adjusted yield. This means consistent performance, not unstable spikes.

Concrete focuses on safety by using audited smart contracts and clearly documented strategies. This approach makes the vaults suitable for everyday users and institutions looking for a reliable DeFi yield product.

When you deposit into a Concrete Vault, you receive a ct[asset] token. This token increases in value as the vault earns, so your position compounds automatically. There’s no need to claim rewards or manage harvest timers—the vault handles it.

Each vault allocates assets across vetted DeFi strategies, liquidity markets, and restaking opportunities. The system adjusts positions as conditions change to maintain balanced, risk-aware performance.

Yes. Users can withdraw their funds at any point. Your ct[asset] tokens represent your share in the vault and can be redeemed whenever you choose.

No DeFi product is risk-free, but Concrete prioritizes safety with audited contracts, conservative modeling, and transparent documentation. Users are encouraged to understand the risks and use the vaults responsibly.

The challenge in DeFi has never been the lack of opportunities—it’s the amount of work required to manage them. Concrete Vaults offer a way to participate without needing to juggle dozens of protocols or monitor yields all day. For newcomers, it’s an accessible starting point. For experienced users, it’s a tool that saves time and reduces stress.

If you’re looking for automated yield backed by thoughtful risk management, Concrete Vaults are worth exploring.

Start here: