Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Newcomers to the Core blockchain often encounter simple analogies—like games or savings accounts—to explain staking and participation. These can be helpful for getting started, but they sometimes oversimplify the deeper mechanics.This post takes a more straightforward look at how things really work. We’ll focus on the core structure: staking mechanics, incentive design, and the emphasis on long-term commitment, drawing from the network’s Satoshi Plus consensus.The aim here is clarity, not promotion—just an explanation that stands up to scrutiny.

The Core blockchain is an EVM-compatible Layer-1 network that integrates deeply with Bitcoin’s security model through its Satoshi Plus consensus. This hybrid approach combines:

This setup lets developers build Ethereum-style smart contracts while leveraging Bitcoin’s hash power and staked assets for security.One key point: Core isn’t built primarily as a high-yield farming chain. Its design prioritizes network security, decentralization, and sustainable growth over short-term speculative gains. Rewards exist, but they’re tied to contributing to long-term stability.

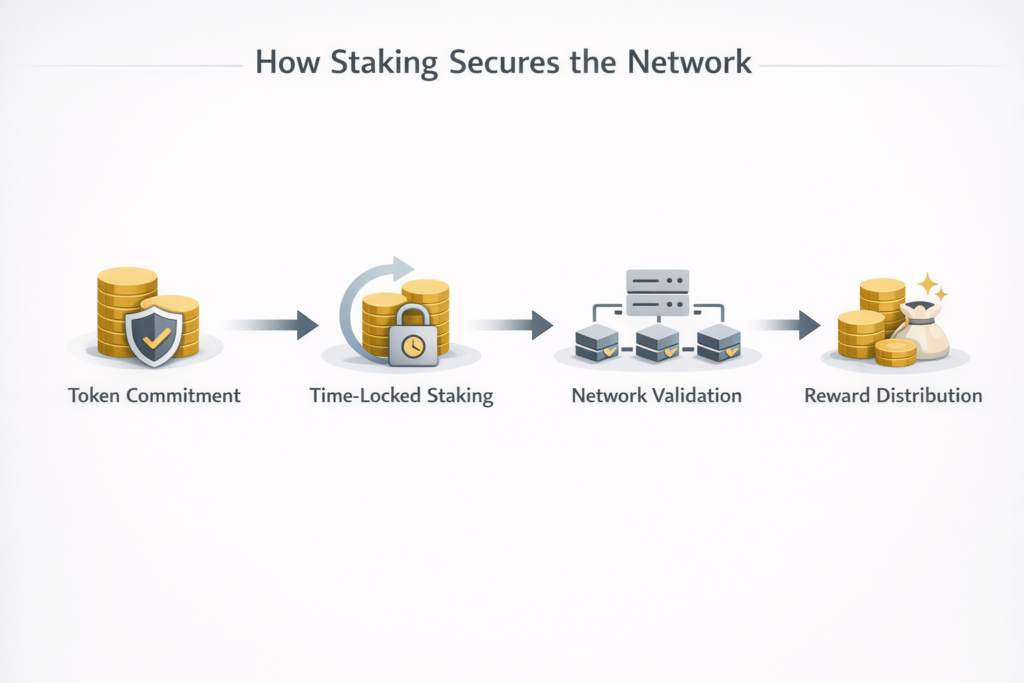

Overall, staking signals genuine alignment with the network’s health rather than just chasing quick rewards.

Core treats participation differently based on commitment level:

Importantly, longer commitments don’t automatically mean massively higher rewards. Yields depend on dynamic factors like total staked Bitcoin, network activity, governance-set parameters, and market conditions. Patience helps with stability, but outcomes vary.

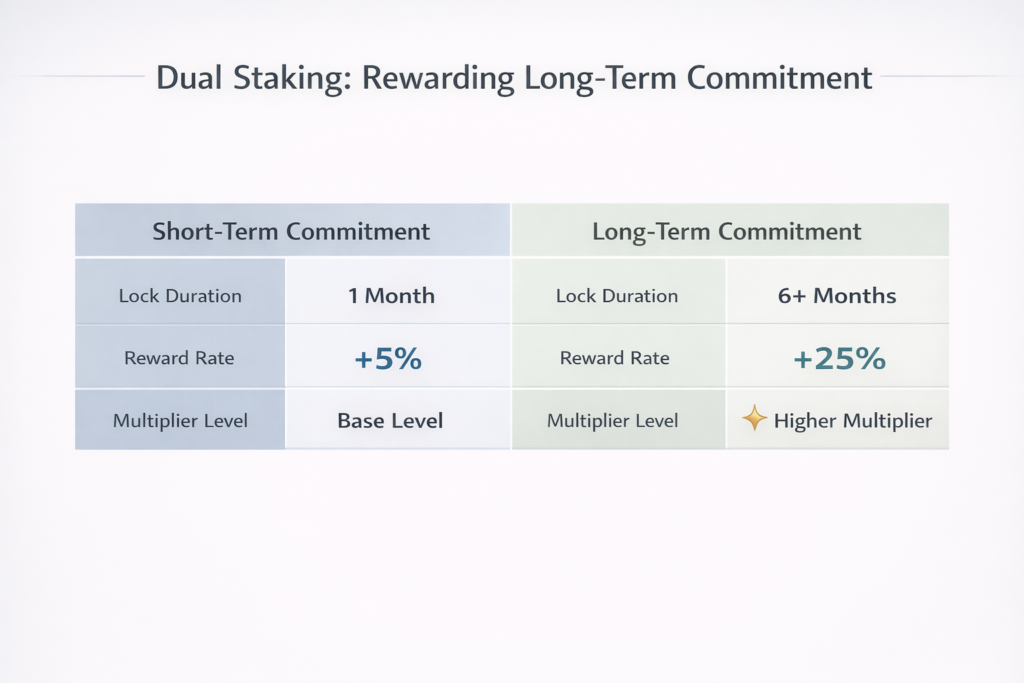

Core’s Dual Staking model lets participants stake both Bitcoin (self-custodially via timelock) and CORE tokens simultaneously.The core idea: Pairing the two demonstrates stronger alignment with the ecosystem, as it combines Bitcoin’s security with CORE’s staking participation. This unlocks tiered yield multipliers on Bitcoin staking rewards (paid in CORE tokens):

Dual Staking adds complexity compared to simple “lock and earn” models, but it makes the system more resilient by rewarding deeper commitment and tying incentives between Bitcoin holders and the Core ecosystem.Note: CORE staking rewards are separate and not directly boosted by Dual Staking— the main boost applies to Bitcoin yields.

Core is governed by a DAO where CORE token holders can propose and vote on changes, including:

This flexibility is crucial—markets evolve, Bitcoin staking volumes grow, and security needs change. Governance allows adjustments that rigid, fully automated systems can’t handle easily.It doesn’t remove all risks or debates, but it enables the network to adapt over time.

The benefits of sustained participation often show up gradually, not in short-term charts:

These aren’t guaranteed, but they’re what the design encourages through alignment incentives.

Core represents a shift toward commitment-focused blockchain design, blending Bitcoin’s proven security with scalable smart contracts. Its staking and incentives reward long-term alignment over instant gratification.Simple analogies are great for onboarding, but they can gloss over nuances like variable yields, governance influence, and the focus on security.Ultimately, the approach’s success depends on how the community—Bitcoin holders, CORE stakers, miners, and builders—engages over multiple cycles.For the latest details, check official sources like coredao.org and docs.coredao.org, as parameters can change via governance.

If you want to learn more, ask questions, or follow updates from the Core DAO ecosystem: